Simply put, a Financing Term is the set of conditions, provisions and agreements related to borrowing or investing money. These agreements established the financial structure that specifies how money flowed, was employed and reimbursed. Interest rates, payment due dates and amount of repayments (re-purchase plan) notable fees and covenants associated with the financing terms significantly affect both cost as well how a transaction is managed. It is essential for both parties — the application a potential borrower and your business to understand what they mean because it defines exactly how much money will need you incur in over time, as opposed to receive.

20 Financing Term that you should know :

1. Principal Amount

Definition: The original amount of money borrowed or invested, before any interest or fees are added.

Example: Imagine you want to buy a car and decide to take out a loan. You borrow RM10,000 from a bank. In this case, the principal amount is RM10,000. This is the amount you’ll need to pay back over time.

As you make your monthly payments, part of that money goes toward paying off the principal, while another part covers the interest the bank charges. For example, if your loan has an interest rate of 5% per year, you’ll end up paying back not just the RM10,000 but also some extra in interest. This means you need to be aware of how the principal influences your total repayment amount in financing term.

If you decide to make extra payments toward the principal, you can actually reduce how much interest you’ll pay in the long run and even pay off the loan faster. This illustrates how understanding the principal amount can empower you to make smarter financial choices in financing term.

2. Interest Rate (Financing Term)

Definition: The cost of borrowing money, expressed as a percentage of the principal.

Example: Imagine you decide to take out a personal loan of RM10,000 to renovate your home. The bank offers you a fixed interest rate of 6% per year.

If you choose a loan term of 5 years, your monthly payments will consist of both the principal amount and the interest. With a 6% interest rate, over the course of the loan, you’ll end up paying around RM1,500 in interest. So, by the time you finish paying off the loan, you’ll have paid a total of about RM11,500. Understanding this example of financing term helps you see how much extra you’re paying just because of the interest rate.

3. Amortization Schedule

Definition: A detailed plan showing each loan payment in financing term and how much goes toward the principal and interest.

Example: Let’s break down the concept of an amortization schedule with a straightforward example that’s easy to understand.

Scenario: RM5,000 Loan

Loan Amount: RM5,000

Annual Interest Rate: 4%

Loan Term: 3 years (36 months)

Monthly Payment Calculation

To find out your monthly payment, you can use a simple formula or an online calculator. For this example, the monthly payment would be approximately RM149.24.

Amortization Schedule Overview

Here’s a simplified view of the first few months of the amortization schedule:

| Month | Payment | Interest | Principal | Remaining Balance |

|---|---|---|---|---|

| 1 | RM149.24 | RM16.67 | RM132.57 | RM4,867.43 |

| 2 | RM149.24 | RM16.24 | RM133.00 | RM4,734.43 |

| 3 | RM149.24 | RM15.73 | RM133.51 | RM4,600.92 |

| 4 | RM149.24 | RM15.33 | RM133.91 | RM4,467.01 |

| 5 | RM149.24 | RM14.78 | RM134.46 | RM4,332.55 |

| … | … | … | … | … |

| 36 | RM149.24 | RM0.50 | RM148.74 | RM0.00 |

Payment: Every month, you pay RM149.24.

Interest: This is the amount of your payment that goes to interest. For the first month, it’s about RM16.67 (4% annually means 0.33% monthly on the remaining balance).

Principal: This is how much of your payment reduces the loan balance. In the first month, it’s about RM132.57.

Remaining Balance: This shows how much you still owe after each payment. After the first month, your balance will be RM4,867.43.

4. Grace Period

Definition: Extra time after a payment is due during which you can still pay without a penalty.

Example: Imagine you take out a student loan for RM5,000. Your first monthly payment is due on January 1, but because you’re still in school, you have a 6-month grace period. This means you don’t have to start paying until July 1.

How it works in Financing Term?

Loan Starts: You take the loan, and you know that your first payment won’t be due until July. This gives you some breathing room while you finish your studies.

Grace Period: Since you have a 6-month grace period, your first payment is not required until July 1. If you pay by this date, you won’t have to worry about any penalties.

Payment Timing:

If you make your payment on or before July 1, you’re in the clear—no late fees or interest!

If you wait and pay on July 15, you’re still within that grace period, so you won’t face any extra charges.

However, if you miss July and end up paying in August, you might incur a late fee or interest on the loan.

5. Disbursement in Financing Term

Definition: The process of releasing funds to the borrower as agreed in the loan terms.

Example: Imagine a small graphic design company called “Creative Designs.” They’ve done a lot of work for clients but are waiting on RM50,000 in unpaid invoices.

- Factoring Agreement: To get cash flowing again, Creative Designs decides to work with a factoring company. They agree to sell those unpaid invoices to the factoring company for a fee.

- Discount Rate: The factoring company offers to buy the invoices for 80% of their value. So, Creative Designs will receive RM40,000 right away.

- Disbursement Process:

- Immediate Cash: Once everything is set up, the factoring company disburses RM40,000 to Creative Designs. This gives the company instant cash to pay employees and cover other expenses.

- Collecting Payments: After that, the factoring company takes on the job of collecting the full amounts from the clients. They handle the invoicing and follow-ups.

- Final Payment: Once the clients pay their invoices, the factoring company keeps the remaining RM10,000 (which is the 20% fee for their service).

6. Prepayment Penalty

Definition: A prepayment penalty is a fee charged by lenders if a borrower pays off their loan early. This is typically included in mortgages, personal loans, or car loans. Let’s look at a simple example to understand how it works in financing term.

Example: Scenario: Home Mortgage

Loan Amount: RM200,000

Interest Rate: 4%

Loan Term: 30 years

Prepayment Penalty: 2% of the remaining balance if paid off within the first 5 years

How it works?

Initial Agreement: When you take out the mortgage, you agree to a 30-year loan with a 4% interest rate. However, there’s a clause stating that if you pay off the loan in the first 5 years, you’ll incur a 2% prepayment penalty on the remaining balance.

Paying Off Early: After 3 years, you decide to sell your house and pay off the mortgage. At that point, your remaining balance is approximately RM190,000.

Calculating the Penalty: Since you are paying off the loan early, the prepayment penalty applies:

- Penalty Fee: 2% of RM190,000 = RM3,800.

Final Costs: When you pay off the mortgage, you’ll need to pay the remaining balance of RM190,000 plus the RM3,800 penalty, totaling RM193,800.

7. Covenants (Financing Term)

Definition: Conditions set by the lender that the borrower must follow during the loan term.

Example: Imagine a small manufacturing company called “ABC Widgets” that takes out a loan for RM500,000 to expand its business. As part of the loan, the lender includes some important rules, known as covenants.

One rule is that in financing term ABC Widgets must show they are making enough money to cover their loan payments. If their annual payment is RM100,000, they need to earn at least RM125,000 to ensure they can pay it back.

Another rule requires ABC Widgets to send financial reports to the lender every few months. This helps the lender keep track of the company’s financial health.

Lastly, ABC Widgets cannot take on extra debt without the lender’s approval. This keeps the company from overextending itself financially.

These covenants help protect the lender’s investment while allowing ABC Widgets to grow responsibly in financing term.

8. Secured Loan

Definition: In financing term, a secured loan is when you borrow money and back it with an asset, like a car or a house. This means that if you don’t pay back the loan, the lender can take that asset.

Example: Imagine you want to buy a car that costs RM20,000, but you only have RM5,000 saved up. To cover the rest, you decide to take out a secured loan from a bank for RM15,000.

In this case, the car itself acts as collateral for the loan. This means that if you run into financial trouble and can’t make your payments, the bank has the right to repossess the car.

The bank offers you a loan with a 5% interest rate and a repayment term of 5 years. You agree to make monthly payments, and as long as you keep up with those payments, you’ll fully own the car once the loan is paid off.

9. Unsecured Loan

Definition: An unsecured loan is a type of loan that isn’t backed by collateral. This means the lender can’t take an asset if you fail to repay.

Example: Imagine you suddenly need RM10,000 for unexpected medical expenses. Since you don’t have any valuable assets to offer as collateral, you decide to apply for an unsecured personal loan from a bank.

- Loan Amount: You apply for and receive a RM10,000 loan.

- Interest Rate: Because it’s unsecured, the bank charges a higher interest rate—let’s say 10%. This is because they’re taking on more risk by lending you money without any collateral.

- Repayment Terms: The bank offers you a repayment period of 3 years. You agree to make monthly payments during this time.

- No Collateral: Since there’s no asset tied to the loan, the bank relies on your credit history to decide whether to lend you the money. If you don’t pay back the loan, they can’t take anything specific from you, but they can pursue collections or report it to credit agencies, which can hurt your credit score.

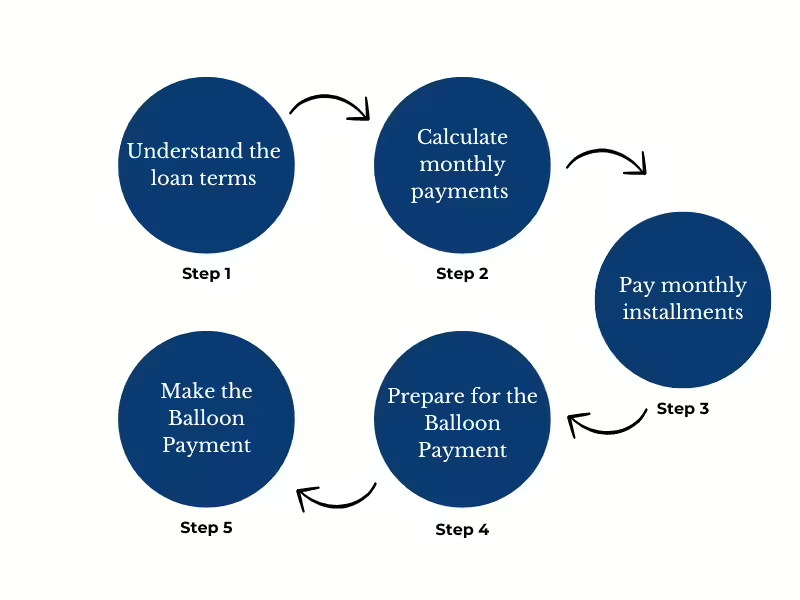

10. Balloon Payment in Financing Term

Definition: A balloon payment in financing term is a big final payment due at the end of a loan after making smaller payments throughout the loan term.

Example: Imagine you own a small bakery and need to buy new equipment, so you take out a loan for RM100,000. Here’s how the loan is structured:

- Loan Amount: You borrow RM100,000.

- Interest Rate: The interest rate is 6%.

- Loan Term: The loan lasts for 5 years.

- Monthly Payments: For the first 4 years, you make manageable monthly payments of about RM1,500.

- Balloon Payment: At the end of the 5 years, you have a final balloon payment of RM80,000. This means that while you’ve paid around RM72,000 in total during those four years, you still owe a large chunk at the end.

11. Line of Credit

Definition: A flexible loan allowing you to borrow up to a certain limit as needed.

Example: Imagine you run a small marketing agency and want some extra cash for unexpected expenses or opportunities. To manage this, you decide to apply for a line of credit.

- Credit Limit: The bank approves you for a line of credit of RM50,000. This means you can borrow up to that amount whenever you need it.

- Accessing Funds: You don’t have to take out the entire amount at once. For instance, you might withdraw RM10,000 to cover an urgent expense, like hiring a freelancer for a big project.

- Interest Charges: You only pay interest on the amount you actually use. If you take out RM10,000 and the interest rate is 8%, you’ll only be charged interest on that RM10,000, not the whole RM50,000.

- Repayment: Once the project is finished and your client pays you, you can easily pay back the RM10,000. After you repay it, that amount becomes available for you to borrow again whenever you need it.

12. Loan Term

Definition: The total time you have to repay the loan.

Example: Imagine you’re buying a house and need a mortgage for RM300,000.

- Loan Term: You decide on a loan term of 30 years. This means you have 30 years to pay back the money you borrowed.

- Monthly Payments: Because you’ve chosen a longer term, your monthly payments will be lower—around RM1,400, depending on the interest rate.

- Total Interest Paid: Over those 30 years, you’ll pay interest on the loan, which can add up. In this case, you might end up paying about RM200,000 in interest over the life of the loan due to the longer repayment period.

- Shorter Loan Term Option: If you had opted for a 15-year term instead, your monthly payments would be higher—about RM2,200. However, you’d pay significantly less interest overall, maybe around RM100,000.

13. Net income in Financing Term

Definition : In financing term, net income is what you have left after all expenses, taxes, and costs are deducted from your total revenue.

Example : Imagine you own a cozy coffee shop. Here’s how your finances look for one month:

- Total Revenue: Your shop brings in RM20,000 from sales during the month.

- Expenses:

- Cost of Goods Sold (like coffee, milk, and pastries): RM5,000

- Rent: RM2,000

- Utilities (electricity and water): RM500

- Salaries (for your baristas and staff): RM8,000

- Other Expenses (supplies, marketing): RM1,000

- Total Expenses: When you add it all up, your expenses are:

- COGS: RM5,000

- Rent: RM2,000

- Utilities: RM500

- Salaries: RM8,000

- Other Expenses: RM1,000

- Total: RM16,500

- Net Income Calculation:

- Total Revenue: RM20,000

- Total Expenses: RM16,500

- Net Income: RM20,000 – RM16,500 = RM3,500

14. Fixed Interest Rate

Definition: An interest rate that stays the same throughout the loan’s term.

Example: Imagine you’re buying a house and decide to take out a mortgage for RM250,000.

- Loan Amount: You borrow RM250,000 to help purchase your new home.

- Fixed Interest Rate: The bank offers you a fixed interest rate of 4%. This means that no matter what happens in the market, your interest rate won’t change.

- Loan Term: You choose a 30-year term for your mortgage, which is pretty common for homebuyers.

- Monthly Payments: Because your interest rate is fixed, your monthly payment will remain steady over the entire loan period. With a 4% rate, you can expect to pay about RM1,193 each month.

- Total Interest Paid: Over the 30 years, you’ll pay a total of approximately RM179,000 in interest. The good news is that your payment amount won’t change, making it easier for you to budget in.

15. Guarantor in Financing Term

Definition : A guarantor is a person or entity that agrees to take responsibility for a borrower’s debt if the borrower fails to make payments. Essentially, the guarantor acts as a backup, promising to cover the loan or obligation if the primary borrower does not fulfill their repayment duties.

Example : Crystal Supplies uses a factoring company for cash but needs a guarantor due to its limited credit. Jane, the owner, asks her brother Tom to be the guarantor. If Crystal Supplies defaults, Tom must cover the debt, providing the factoring company with extra security.

16. Funding

Definition : Money provided for a particular purpose. For business loans, this is the cash the lender provides upfront to the borrower with the agreement that the borrower will repay the funds along with any additional interest and fees.

Example : BuildRight, a construction company, has RM100,000 in invoices but needs cash to pay workers. It goes to a factoring company, which buys the invoices and gives BuildRight RM80,000 upfront. Once clients pay the invoices, the factoring company keeps its fee and gives BuildRight the rest. This helps BuildRight get cash quickly to pay its workers.

17. Factor Rate

Definition : A factor rate is the fee charged by a factoring company for purchasing a business’s accounts receivable. It is expressed as a percentage of the total invoice amount and helps determine the cost of factoring.

Example : QuickHaul, a trucking company, sells RM50,000 in invoices to a factoring company with a 3% factor rate. This means QuickHaul pays RM1,500 as a fee. They get RM40,000 upfront (80% of the invoices), and after clients pay, the factoring company keeps the fee and gives QuickHaul the remaining RM8,500.

18. Disbursement Schedule in Financing Term

Definition: A plan showing when and how funds will be released to the borrower.

Example: Imagine you’re funding a construction project to build a new community center, and the total budget is RM500,000. Here’s how the disbursement schedule might work:

- Initial Payment: At the start of the project, you make an initial payment of RM100,000. This covers upfront costs like permits and materials.

- Milestone Payments:

- After Foundation Completion: Once the foundation is finished, you release another RM150,000 to keep the project moving.

- After Framing Completion: When the framing of the building is done, you disburse RM100,000.

- After Roofing and Windows: After the roofing and windows are installed, you release another RM100,000.

- Final Payment: Once everything is completed and passes inspection, the final $50,000 is paid.

19. Equity

Definition: The value of ownership interest in an asset, like a home or business, after subtracting any liabilities.

Example: Imagine you buy a house for RM300,000. To help with the purchase, you take out a mortgage for RM250,000.

- Initial Equity: When you first buy the house, your equity is the difference between the home’s value and what you owe on your mortgage.

- Home Value: RM300,000

- Mortgage Amount: RM250,000

- Equity: So, your initial equity is RM300,000 – RM250,000 = RM50,000.

- Building Equity: As time goes by, you make monthly payments, and your mortgage balance goes down to RM200,000. Plus, let’s say the value of your home increases to RM350,000.

- Current Equity Calculation:

- Current Home Value: RM350,000

- Remaining Mortgage: RM200,000

- Equity: Now, your equity is RM350,000 – RM200,000 = RM150,000.

20. Refinancing in Financing Term

Definition: Replacing an existing loan with a new one, usually to get better terms.

Example: Let’s say you bought a home a few years ago and took out a mortgage for RM200,000 at a 5% interest rate. Your monthly payment is around RM1,073.

- Current Situation: After a few years, you still owe about RM180,000 on your mortgage. You find out that interest rates have dropped to 3.5%.

- New Loan: You decide to refinance. This means you’ll take out a new loan for RM180,000 at the lower 3.5% rate.

- Monthly Savings: With the new rate, your monthly payment drops to about RM808. That’s a savings of about RM265 each month!

- Long-Term Savings: Over the life of the new loan, you could save around RM40,000 in interest.

In conclusion, understanding financing terms is really important for anyone navigating the often confusing world of personal or business finance. These terms are more than just complicated words, they help you make choices that can affect your financial future. When you know about things like interest rates, repayment plans, and different fees, you can make better decisions that improve your financial situation. Also, by learning about these concepts, you’ll be better equipped to handle loans, investments, and everyday financial decisions. Whether you’re running a business looking for funding or planning your personal finances, understanding these terms can help you feel more confident and in control of your financial journey.