In this article, we will delve deep into how Commerze Capital can provide financial solutions to benefit the Oil & Gas industry. We will first discuss the history of Oil and Gas in Malaysia, how the industry works, and who are the main players in the Oil & Gas industry. Lastly, we will see the common problems that often arise within the industry and how Commerze Capital can help tackle these problems.

Brief History of the Oil & Gas Industry in Malaysia

The exploration of oil and gas in Malaysia began more than a century ago, when Shell discovered the country’s first oil well in Sarawak, in 1910. After that, Exxon and Shell were then granted permission to explore and produce oil under the 1966 Petroleum Mining Act, which initially governed oil and gas activities in Malaysia in exchange for royalties and tax payments to the government.

However, the government quickly realized that more control over its petroleum resources would be strategically valuable, and so the Petroleum Development Act (PDA 1974) was created under the New Economic Plan. With the passage of this Act, a fully owned government corporation with exclusive rights to all of Malaysia’s oil and gas resources was established, giving birth to PETRONAS.

Now, Malaysia serves as a vital hub for significant oil and gas businesses, with PETRONAS being one of the world’s largest producers of LNG. Situated in the world’s third-biggest LNG export market, Malaysia boasts more than 400 oil and gas fields and is the second-largest reserve in ASEAN. This robust ecosystem is currently one of the main factors propelling the growth of Malaysia’s economy, contributing up to 20% of the country’s annual GDP.

Oil & Gas Companies in Malaysia

Malaysia has positioned itself to effectively satisfy the regional and domestic needs of the oil and gas value chain. This is in step with the nation’s goals to establish itself as a regional hub for oil and gas. Currently, the ecosystem comprises more than 3500 international oil companies, independents, services, and manufacturing companies.

Here, we list some of the biggest oil and gas company operating in Malaysia.

1. PETRONAS (Petroliam Nasional Berhad)

PETRONAS, Malaysia’s national oil company is not just a domestic market leader but also a worldwide player committed to sustainable energy solutions. It is a prominent global energy business dedicated to driving societal progress responsibly and sustainably. With nearly 50,000 workers and a global reach of over 100 countries, PETRONAS is rated among the world’s largest firms by revenue on Fortune Media IP Ltd’s 2022 Fortune Global 500® list. Fast forward to 2024, they are celebrating their 50 years of establishment on 17 August.

2. Shell Malaysia

Shell Malaysia, a subsidiary of Royal Dutch Shell, combines their globally renowned expertise with a strong regional presence, to make a substantial contribution to Malaysia’s energy needs. Until 2024, Shell Malaysia has been operating in Malaysia for 133 years, since they first commenced operations as “Marcus Samuel & Company” setting up oil storage depots at various Straits Settlements ports. Today, Shell maintains a strong multi-faceted presence in the country through longer-term investments, innovation-sharing, and impact on local communities. They have helped pioneer Malaysia’s oil and gas industry and fueled its growth.

3. ExxonMobil Malaysia

As part of ExxonMobil, ExxonMobil Malaysia offers the global standard to Malaysia, providing a consistent supply of energy resources for the country. They celebrated their 130 years of doing business in Malaysia in 2023. During this time, they have progressed from selling kerosene for lighting bulbs to developing some of the country’s main oil and gas plants, and are now exploring possible carbon capture and storage projects for its energy transition. ExxonMobil Malaysia continue to be among the biggest energy producer in Malaysia, accounting for approximately 40% and 50% of Peninsular Malaysia’s crude oil and natural gas production, respectively.

4. TotalEnergies Malaysia

TotalEnergies is dedicated to providing innovative and eco-friendly energy solutions, contributing to Malaysia’s sustainable development. It first entered Malaysia in 1985 under the ELF brand, and today distributes lubricants, glass coatings, industrial oil, and specialty products. Now, they are mainly active in Malaysia in the solar market and the oil and gas exploration sector. They also lead several community outreach initiatives in the country. Today, they have a market share of roughly 6% and a turnover of more than MYR 130 million per year.

5. Chevron Malaysia Limited

Chevron’s global expertise promises a consistent supply of energy resources, which promotes economic progress and environmental responsibility in Malaysia. In Malaysia, they are well known for their extensive network of Caltex® service stations. In 2016, Chevron Malaysia Limited celebrated its 80th year in Malaysia. Their staff works in marketing, lubricants, and terminal operations. Chevron Malaysia Limited also takes an active involvement in local communities, focusing on social investment in education, skill development, and training.

How does the Oil & Gas Industry work?

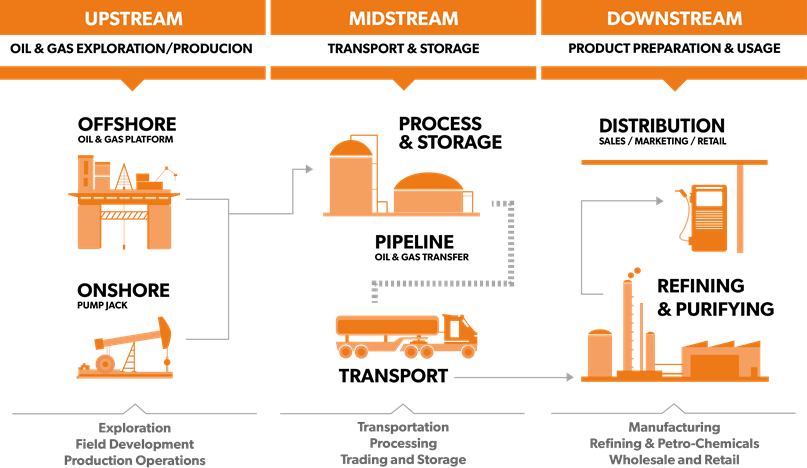

The oil and gas industry is segmented into upstream, midstream, and downstream activities. Upstream activities include exploration, development, production of oil. and gas resources. Midstream and downstream activities include transporting oil and gas, refining and processing, and selling and trading finished products. The figure below shows the different segments in the Oil & Gas industry.

The exploration, production and development of oil and gas often require certain technical services to be performed over oilfield assets. Many of these services are contracts awarded to third-party contractors who perform them under an agreement commonly known as an oil and gas service contract.

Here’s a breakdown of how the procurement of tenders works in Malaysia:

A. The Governing Body in Oil & Gas

Malaysia Petroleum Management (MPM). This agency under PETRONAS manages the tender process for the country’s oil and gas resources. They act on behalf of PETRONAS throughout the lifecycle of upstream oil and gas projects.

B. Eligibility

If investors or contractors want to participate in the exploration and production activities, they must apply for and receive a license from PETRONAS in the form of a Petroleum Arrangement (PA) contract between PETRONAS and the investors (to be referred as PA Contractors). Read more about PETRONAS’s Licensing and Procurement and how to become a vendor here.

What is a PA Contract?

The Petroleum Arrangement (PA) Contract is the primary document governing the activity in Malaysia’s upstream oil and gas sector. It establishes the terms, circumstances, rights, and duties of all parties concerned. A typical PA contract specifies, among others:

Duration & Scope of Contract

Contract Area

Work Programme & Budget

Management & Operations

Division of Gross Production & Cost Recovery

Accounts & Audits

Procurement of equipment, facilities, goods, material, supplies and services

Governing Law & Dispute Resolution

Taxes

Abandonment

You can read more about PETRONAS’s Contracts and Guidelines here.

C. Finding Tenders in the Oil & Gas Industry

Malaysia Petroleum Management (MPM) publishes tender opportunities on its website. Additionally, the national eProcurement platform, ePerolehan, aggregates tenders from various government agencies, including those related to oil and gas. As a general rule, any company that seeks to provide services to any Government agency must first register through the ePerolehan website. For contracts above RM 500,000, an open tender must be issued by the relevant procuring agency.

D. The Tender Process

1. Pre-qualification

Companies express interest in a tender and submit pre-qualification documents to demonstrate their eligibility and qualifications for the project. This might involve technical expertise, experience, financial standing, and safety certifications.

2. Invitation to Tender (ITT)

Shortlisted companies receive an ITT with detailed tender documents outlining the project scope, specifications, evaluation criteria, and submission deadlines.

3. Bid Preparation

Companies develop a comprehensive bid proposal addressing the ITT requirements. This typically includes technical proposals outlining their approach and methodology, along with commercial proposals detailing pricing and project timelines. Bid bonds might be required at this stage.

4. Bid Submission and Evaluation

Companies submit their bids by the deadline. MPM evaluates bids based on pre-defined criteria, which may include technical competency, experience, financial strength, and proposed pricing.

5. Awarding the Tender

MPM selects the winning bidder based on the evaluation and negotiates contract terms.

6. Completing the Project

The contractor will then complete the project awarded as per the contract, including adhering to the regulations set by the Government on how to manage the exploration, production, and development of oil and gas. The Malaysian government prioritizes using locally sourced materials and services in oil and gas projects. MPM is responsible for overseeing the operations and managing the PA Contractors’ performance.

7. Issuing Invoice

After the work is done, the contractor will then issue the invoice to the contract awarder. The contract awarder will process the invoice and pay the contractor the amount due. This can take up to 90 days as the contract awarder will need time to process the invoice and make sure that it is good for payment.

Challenges in the Oil & Gas Industry

1. Tight Cash Flow

Oil and gas projects are usually capital-intensive, meaning it would require the company to invest a lot of money in each project. They can be more towards high-risk high-return projects and smaller companies may struggle with these types of projects. Payments from tenders can also be slow due to lengthy approval processes. This cash flow strain can hinder a company’s ability to meet operational costs and participate in future tenders.

2. Huge Capital Requirements

Contractors will need a lot of capital to even start a project and most contract awarders will prioritize contractors with a healthy and dependable cash flow. Securing tenders sometimes necessitates submitting bid bonds, which can be a significant financial burden, especially for smaller companies.

3. Limited Access to Capital

Smaller companies might struggle to secure traditional loans due to the perceived risk associated with oil and gas projects. Banks are often cautious about providing loans to smaller companies, especially the ones that are new with no previous credit history.

4. Unexpected Additional Costs

Even with meticulous planning, unforeseen circumstances can lead to project cost overruns. This can strain a company’s finances and potentially jeopardize project completion.

How can Commerze Capital Help Your Oil & Gas Business?

1. Invoice Factoring

Invoice factoring allows your company to receive immediate payment for a portion of the invoice value, meaning you do not have to wait for long to receive the invoice payments. Having a healthy cash flow will also mean that you can seamlessly move on to your next projects and seem much more reliable to contract awarders. Read more here to learn how invoice factoring can help your business.

2. Pre-Financing/Contract Financing

Pre-financing from Commerze Capital can help your company cover any upfront costs to start the project. This can increase your eligibility and attractiveness to participate in tenders. Commerze Capital also provides Letter of Support stating that your company is backed financially by our facility to provide extra assurance to the contract awarders.

3. Financial Advisory

Financial advisory services offered by Commerze Capital can help smaller companies secure loans from banks to help them with their capital. Moreover, factoring companies such as Commerze Capital, are usually more lenient in providing financial services than banks. Having access to additional funds allows your company to adapt to unexpected situations without derailing project progress or impacting tender fulfillment.

What are the Advantages of Invoice Factoring, Pre-Financing and Financial Advisory in the Oil & Gas Industry?

1. Improved Your Oil & Gas Business Cash Flow

The biggest advantage is immediate access to a portion of the invoice value. This helps oil and gas companies bridge cash flow gaps between project completion and the contract awarder’s payment, which can be slow and take up to 90 days due to lengthy approval processes. Improved cash flow allows companies to meet operational costs, invest in future projects, and even secure additional tenders.

2. Reduced Financial Strain

With the help of financial solutions like pre-financing, it can relieve some of the financial burden that your company might be carrying. By spreading out the financial burden of tender-related costs, pre-financing helps your oil and gas company avoid straining your capital to kickstart the project.

3. Better Financial Management & Risk Mitigation

Financial advisory helps companies develop realistic project budgets, better cash flow, and mitigate any potential risks. This proactive approach hinders any unexpected complications and ensures smooth project completion.

Conclusion

By utilizing a combination of Invoice Factoring, Pre-Financing, and Financial Advisory services, oil and gas companies can gain a significant competitive edge in the whole process, from securing the tender to completing the projects. This comprehensive approach can address various financial challenges, improve overall financial health, and ultimately increase a company’s chances of securing valuable contracts in Malaysia’s oil and gas industry.

Commerze Capital can become your one-stop solution for your business to participate in Malaysia’s oil and gas industry. We can offer you a combination of invoice factoring, pre-financing, and financial advisory services, and help you overcome your financial hurdles.