Invoice factoring is a financing process where a business sells its unpaid invoices to a factoring company. Invoices can take a long time to be paid and invoice factoring offers a quicker way to obtain the invoice amount. There are a lot of benefits in invoice factoring, including a healthier cash flow and more growth opportunities for your business.

In this article, we will explain how the invoice factoring process works so that you can understand invoice factoring better.

Parties Involved in the Invoice Factoring Process

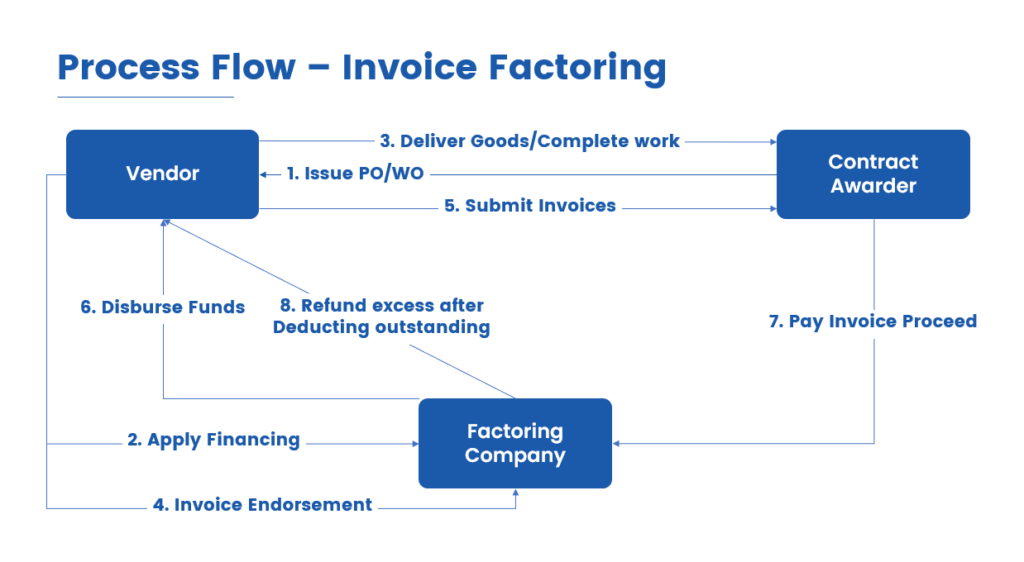

First, we must understand the 3 parties involved in the process of invoice factoring. These would be the key players, entities participating in the whole process of invoice factoring.

1. Contract Awarders

Contract awarders are typically large companies or government agencies that want to buy goods/services from vendors. You can imagine them as customers, and they need something from the sellers (vendors). Read more about what is contract awarding here.

2. Vendors

Vendors are the ones providing the goods/services to the contract awarder. They offer the services in return for cash, usually by submitting invoices to the contract awarders as a form of asking for payment for the work done.

3. Factoring Company

Conventionally, the payment process after the work is done is only between the contract awarder and the vendor whereby, the vendor will issue an invoice to the contract awarder and the contract awarder will pay its amount.

However, in invoice factoring, we can imagine that the factoring company is the third-party entity that would take care of receiving the payment from contract awarders on behalf of the vendors. They provide quick advance money to the vendor based on the invoice amount.

So now that we know the parties involved in invoice factoring, we will dive deeper into the process flow of invoice factoring.

Invoice Factoring Process

1. Contract Awarder Issues a PO/WO to Vendor

The contract awarder will first issue a Purchase Order (PO) or a Work Order (WO) to the Vendor, stating that it needs goods/services provided. This document specifies the goods or services to be provided, the agreed-upon price, and the payment terms. Read more about PO and WO here.

2. Vendor Applies Financing from Factoring Company

The vendor will then approach the factoring company saying that they want to factor their invoice later after the service is done or the products are delivered to the contract awarder. The vendor and the factoring company will then discuss the fees and decide on any agreements that may be important. The factoring company may also do some background checks on the vendor and the contract awarder.

3. Vendor Deliver Goods/Services to the Contract Awarder

The vendor will then complete the work/deliver the goods as needed in the PO/WO. After the work is done, the vendor will issue an invoice as a form of asking for payment.

4. Factoring Company Endorse the Invoice Issued by Vendor

The factoring company will double-check everything so that the services are done per the PO/WO issued. They will then endorse the invoice issued by the Vendor. The endorsement process also involves the vendor signing over ownership of the invoice to the factoring company.

5. Vendor Submit Invoice to the Contract Awarder

The vendor then submits the invoice endorsed by the factoring company to the contract awarder. The contract awarder is notified that the invoice is now assigned to the factoring company and acknowledges that payments are to be made directly to the factoring company.

6. Factoring Company Disburse Funds to the Vendor

After the invoice is submitted to the Contract Awarder, the factoring company will then disburse the funds (advance) to the vendor, up to 80% of the invoice amount.

7. Contract Awarder Pays Invoice Amount to the Factoring Company

The contract awarder will process the invoice and pay the invoice amount to the factoring company.

8. The Factoring Company Refund the Remaining Amount to the Vendor

Lastly, the factoring company will disburse the remaining balance of the invoice amount minus a factoring fee.

Conclusion

Invoice factoring can improve a business’s cash flow and is a viable solution if you are looking for a quicker way for your invoices to be paid. You can read here and decide whether invoice factoring is right for you. It is also important to consult with a financial advisor to understand the risks and benefits involved. Chat with us today and let’s discuss how invoice factoring can benefit your business!